Tax Freedom Day for the average Canadian family fell on June 9 this year, one day later than last, as Canadians saw broad-based — though relatively small — tax hikes over the past year.

That’s according to the conservative-leaning Fraser Institute, which compiles these numbers annually.

The study projects that taxes for the average family (meaning a household of two or more people) will go up by 3.2 per cent, or $1,355, but average income will rise at a slower pace of 2.1 per cent, up by $2,072. In other words, by the Fraser Institute's calculations, tax hikes will eat up about 70 per cent of income gains among Canadian families this year.

Though the Harper government has long sold itself as a tax-cutting machine, critics point out the Tories have introduced all sorts of hidden taxes and rate hikes.

But it’s not just the federal government. The Fraser Institute notes that property taxes (up $47), sales taxes (up $191), payroll and health taxes (up $364) and income taxes (up $589) are seeing hikes.

“No category of taxes decreased between 2013 and 2014,” the institute said in a statement.

The average Canadian family will pay $43,435 total in taxes, or 43.5 per cent of family income, the study estimates.

Story continues below

“With a rising overall tax burden, household budgets get squeezed, limiting the amount of income families have to spend, save or pay down household debt,” said Charles Lammam, an economic policy scholar at the Fraser Institute.

As Canada continues with a long-running program of gradual corporate tax reductions, the share of the tax burden falling on households has been growing. Economist Toby Sanger estimates that 2014 will be the year when, for the first time ever, more than half the federal govenment's revenue will come from personal income taxes.

Tax Freedom Day for corporations fell on Jan. 29 this year, according to the Canadian Labour Congress.

Rising taxes aren’t the only costs putting pressure on households. Energy costs have spiked 5 per cent this year, Scotiabank estimates, and according to National Bank numbers, the percentage of retail spending going to gas is at an all-time high.

Food prices have also been rising faster than overall inflation, with many basic household goods seeing a better than 20-per-cent price increase over the past four years.

Rising costs, along with record-high household debt burdens, are at least partly driving the slowdown in consumer spending in recent months. And growing evidence that Canada’s job market has ground to a halt (Alberta excepted) likely won’t help that situation.

The Fraser Institute notes that the federal government and seven provincial governments are on track to record deficits totalling $18.8 billion this year. The study urges governments to pay down their debt because public borrowing amounts to “deferred taxes.”

But it notes there would be a price to consumers to balancing the books immediately. If governments raised all the money they needed to balance their books this year, Tax Freedom Day would have fallen five days later, the institute said.

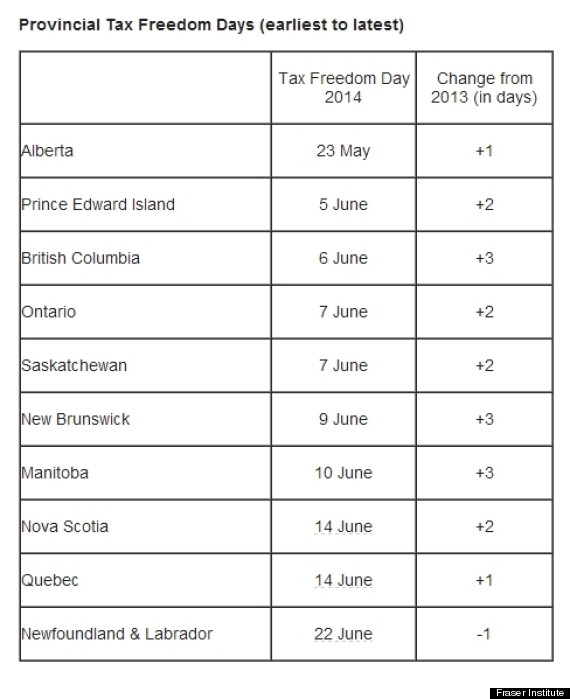

![tax freedom day list]()

That’s according to the conservative-leaning Fraser Institute, which compiles these numbers annually.

The study projects that taxes for the average family (meaning a household of two or more people) will go up by 3.2 per cent, or $1,355, but average income will rise at a slower pace of 2.1 per cent, up by $2,072. In other words, by the Fraser Institute's calculations, tax hikes will eat up about 70 per cent of income gains among Canadian families this year.

Though the Harper government has long sold itself as a tax-cutting machine, critics point out the Tories have introduced all sorts of hidden taxes and rate hikes.

But it’s not just the federal government. The Fraser Institute notes that property taxes (up $47), sales taxes (up $191), payroll and health taxes (up $364) and income taxes (up $589) are seeing hikes.

“No category of taxes decreased between 2013 and 2014,” the institute said in a statement.

The average Canadian family will pay $43,435 total in taxes, or 43.5 per cent of family income, the study estimates.

Story continues below

“With a rising overall tax burden, household budgets get squeezed, limiting the amount of income families have to spend, save or pay down household debt,” said Charles Lammam, an economic policy scholar at the Fraser Institute.

As Canada continues with a long-running program of gradual corporate tax reductions, the share of the tax burden falling on households has been growing. Economist Toby Sanger estimates that 2014 will be the year when, for the first time ever, more than half the federal govenment's revenue will come from personal income taxes.

Tax Freedom Day for corporations fell on Jan. 29 this year, according to the Canadian Labour Congress.

Rising taxes aren’t the only costs putting pressure on households. Energy costs have spiked 5 per cent this year, Scotiabank estimates, and according to National Bank numbers, the percentage of retail spending going to gas is at an all-time high.

Food prices have also been rising faster than overall inflation, with many basic household goods seeing a better than 20-per-cent price increase over the past four years.

Rising costs, along with record-high household debt burdens, are at least partly driving the slowdown in consumer spending in recent months. And growing evidence that Canada’s job market has ground to a halt (Alberta excepted) likely won’t help that situation.

The Fraser Institute notes that the federal government and seven provincial governments are on track to record deficits totalling $18.8 billion this year. The study urges governments to pay down their debt because public borrowing amounts to “deferred taxes.”

But it notes there would be a price to consumers to balancing the books immediately. If governments raised all the money they needed to balance their books this year, Tax Freedom Day would have fallen five days later, the institute said.